Watching the Economy by Clint Burdett CMC® FIMC

Shadow inventory is still a drag on housing sector growth,

even with Existing Home sales picking up.

For 2012, this leading indicator of robust consumer demand has not flashed green! Stormy seas ahead.

Every December, I send my consulting colleagues and clients my economic forecast for the next year.

I have a young man’s vivid memory of skirting a Pacific typhoon and of how badly the frigate wallowed as we worked past the northwest side of the storm (least wind, coldest waters). We knew that we were through the worst, but still, the ship pitched and rolled as we moved away from the storm seeking calm waters.

Here are the key chart/analyses:

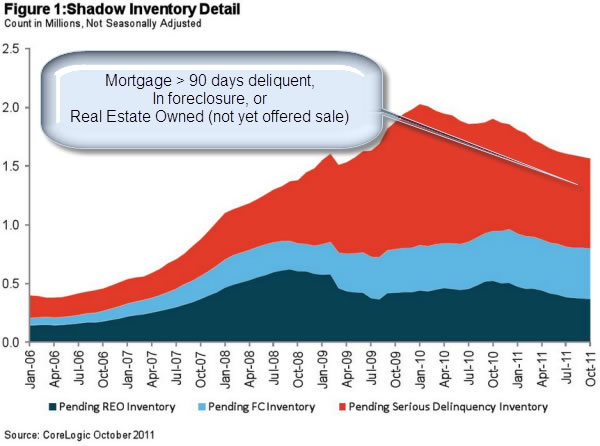

The "shadow inventory" of existing homes about to enter the market is slowly, ever so slowly decreasing.

|

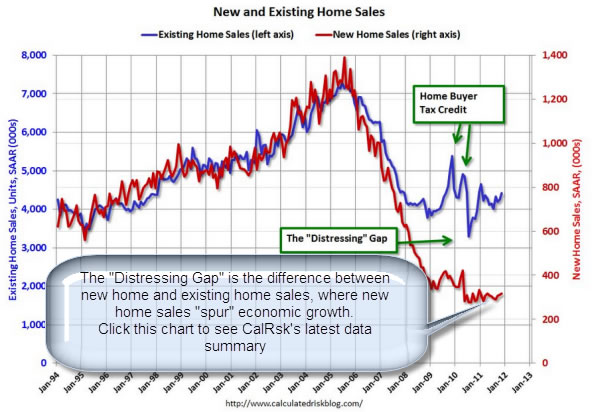

But Existing House sales are moving sideways, perhaps just beginning to pick up.

|

The gap in Existing Home sales to New Home sales has not started to close and the shadow inventory is not included in Existing Homes here. In a healthy housing market, the two closely parallel in movement and number of homes for sale (note the two Y axes' spreads are the same but the values are different).

New Home sales have historically been a key leading indicator for future US GDP growth.

|

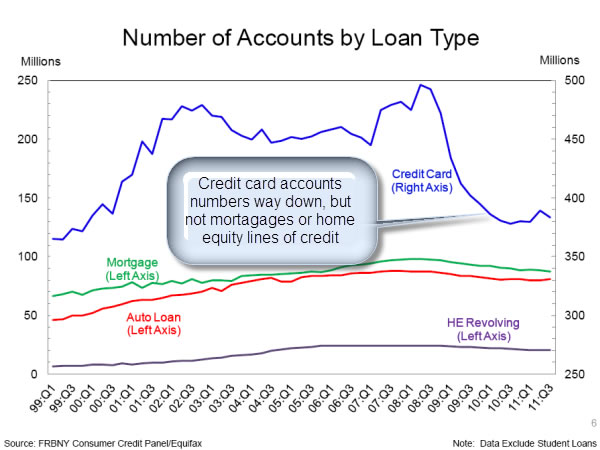

Next to managing debt. Many consumers have closed their credit card accounts.

The number of mortgages (green line) also has been decreasing, either from foreclosures cleared or paid off by baby boomers. There has not been a significant increase in home equity lines of credit. Net, consumers are taking on less debt. That will slow growth.

|

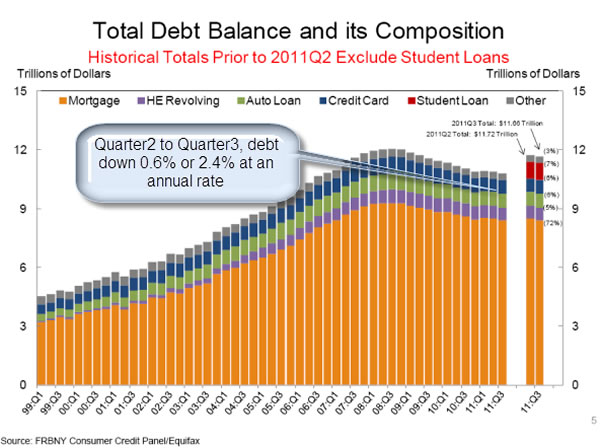

And, we are using our income to pay down debt, mostly mortgages. That's very good long term but will also retard growth next year.

|

These observations are confirmed by examining Real Personal Consumption Expenditure (PCE) rate of change year on year (our national cash flow minus savings minus an inflation deflator compared to the same period last year as a percentage). Real PCE YoY rate of change has been trending down since January 2011. Consumer demand, especially for big ticket purchases in not growing fast enough.

2012 is going to be a difficult growth year as we continue to deleverage (see Mark Carney's, Governor of the Bank of Canada, 12/12/11 speech for the global perspective). Stormy seas ahead

|

Some of you are in niche businesses that will grow and prosper during 2012, but from the macro perspective, the US can only grow slowly until the shadow inventory of homes near to foreclosure is worked off. Building new homes is the fundamental growth engine for the US and when first time buyers show up (in econ speak household formation), they will dig us out of the hole. But, these youngsters will need steady jobs to take on a mortgage and attractive prices to take the plunge. Early signs are that is happening as consumers deleverage, as job growth is hinted and as boomers retire.

The baby boomers moving into retirement will be discussed ad nauseam but the good news (not if you over 60) is that better paying jobs will open up.

As US GDP growth begins to return to its historical performance in the next year (3% to 4% average growth per year), our government debt as a percentage of GDP will begin to decrease, slowly, but politicians will manipulate that reporting in 2012 to influence the election. It is a given that major stimulus during an election year is not going to happen.

Congress will hold the debt line, while the Fed is slowly, ever so carefully, inflates the currency to reduce our debt burden.

Some Federal Reserve Bank Presidents (the FOMC) will be nervous in public about when the spigot finally opens, consumer demand takes off and ratchets up core inflation. These three forces, growth of debt slowing down, government spending slowing down and inflation showing up, will improve confidence in the second half of the year.

Then the Fed will put the brakes on in mid-2013 to 2014, which will scare us all, and those expectations will become the topic du jour in late 2012 as we bore with the election.

Boomers shifting assets from growth equities to income producers will keep the markets gyrating as withdrawals begin. 2011 was a good earnings year, but the market returns were lousy (S&P +0.6% 12/24/10 to 12/23/2011).

Europe enters a mild-recession, so China and India will lose some of their export muscle and will need to look more inward to manage, later, their debt bubbles. China will be more assertive to stabilize the global bond markets, to protect China and to manage a soft landing. This may "shock" equity markets at major government bond sales to refinance.

Nothing can move the "USS Economy" to calm waters in 2012, we are just going to lurch with a quartering stern swell (Europe) and get a bit sea sick every now (election politics) and then as we inch away from the storm (economies recover at their on pace). Keep your eye on the distant horizon to calm your stomach (conservative but just so). Hope for fair winds and gentle following seas.

If Europe implodes, I'm moving the Canada if the gates are still open. Next year, I may have a Canadian theme eh for my forecast.

You may not reprint this article for sale without my expressed written permission.

You may post or reprint this article to educate as long as you credit my work

and provide a link to www.clintburdett.com

|

|