Watching the Economy by Clint Burdett CMC® FIMC

January 30, 2012

USA Making Progress on Deleveraging

Maybe I'm stretching for good news ... the USA is making progress on deleveraging, reported in many economic media. The New York Fed reported the last aggreate data on November 28 on Q3 2011 that:

- Mortgage balances on consumer credit reports fell by approximately $114 billion or 1.3 percent over the third quarter while home equity lines of credit balances increased by roughly $14 billion or 2.3 percent.

- Non-real estate indebtedness now stands at $2.62 trillion, about 1.3 percent above its Q2 level.

- Aggregate credit card limits declined by about $25 billion slightly offsetting increases from earlier this year.

- Open credit card accounts declined by 6 million to 383 million in the third quarter and credit card borrowing limits fell again, partially offsetting some gains seen earlier in the year.

- Open credit card accounts for third quarter were approximately 23 percent below the peak in second quarter 2008 and balances on those cards were nearly 20 percent below their highest levels in fourth quarter 2008.

- Credit account inquiries within six months, an indicator of consumer credit demand, increased for the second quarter in a row.

- Overall delinquency rates increased to 10 percent as of the end of September, compared with 9.8 percent at the end of June.

- Approximately $1.2 trillion of consumer debt is delinquent with $834 billion being seriously delinquent (more than 90 days).

- About 2.5 percent of current mortgage balances transitioned into delinquency in the third quarter, reversing a recent trend of reductions in this measure.

- New foreclosures decreased 7 percent quarter over quarter and bankruptcies declined 18.8 percent year over year.

|

American consumers are cleaning up their balance sheets and the delinquency rate for single family homes has peaked , yet remains very high around 10%, well above the 2% to 3% historical the pattern. There is good news out there, well just a bit of good news.

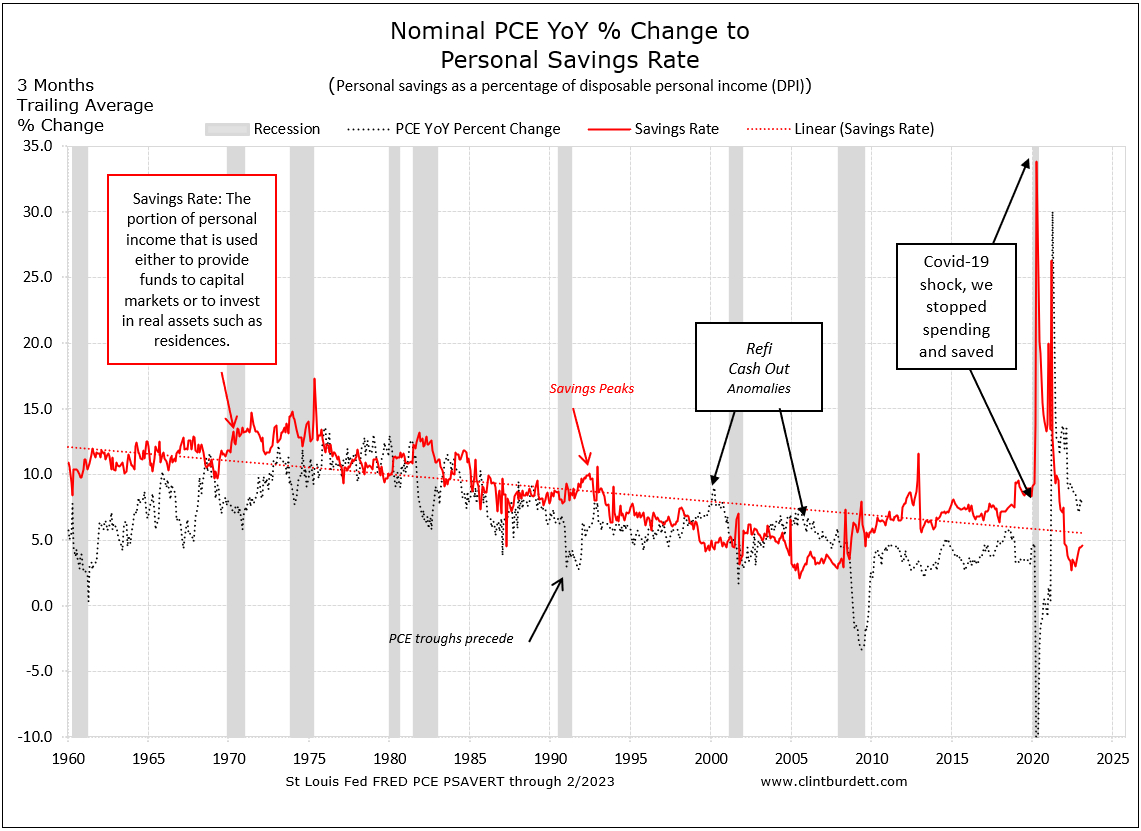

Few seem concerned we'll roar back too quickly (the Fed's estimates of inflation), and December nominal PCE and personal savings rates suggest we continue to be cautious.

Click for larger image

The next chart highlights the political debate, focused all on government debt. That is a major reason why we're being cautious. So the consumer is muddling through in this election year. Note the rate of growth from the previous year is trending down for both consumers and the Federal Government.

Click to go to St Louis Fed FRED

You may not reprint this article for sale without my expressed written permission.

You may post or reprint this article to educate as long as you credit my work

and provide a link to www.clintburdett.com

|

|