Watching the Economy by Clint Burdett CMC® FIMC

November 15, 2013

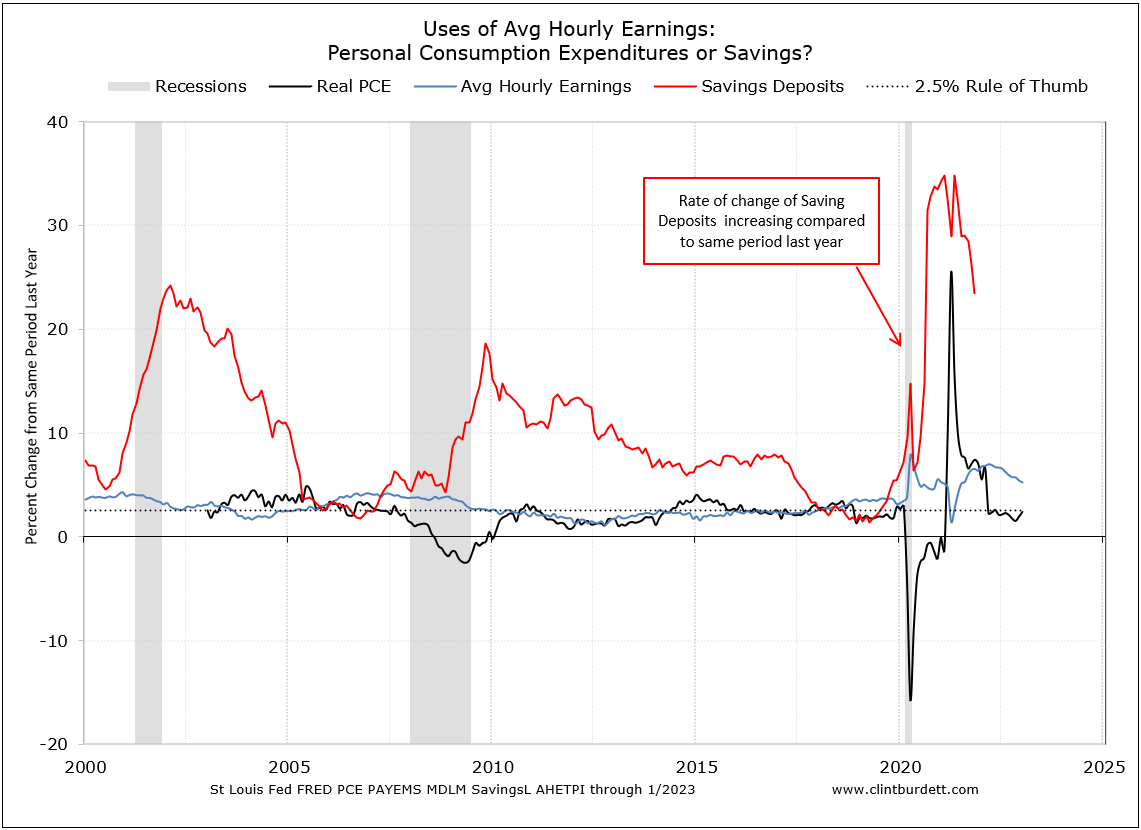

PCE Trending Down as We Save Less and Are Not Getting Raises

We are getting back to the pre-Great Recession peaks in GDP, Employment, Industrial Production and Real Personal Income less transfer payments but not roaring ahead.

The Personal Consumption Expenditure (PCE) measure is the component statistic for consumption in GDP collected by the BEA. It consists of the actual and imputed expenditures of households and includes data pertaining to durable and non-durable goods and services. It is essentially a measure of goods and services targeted towards individuals and consumed by individuals. (Wikipedia)

It is used to determine spending patterns for consumption and the effects of inflation, a measure of our willingness to spend.

For the economy to grow in line with its historical trend, a rule of thumb is PCE should growth 2% or more compared to the previous year to see 3% or better GDP growth.

We see the savings deposit rate of growth increasing or declining considerably (an immediate source of cash) compared to the previous year. Nor are raises (Average Hourly Earnings) growing compared to last year, and as a result PCE is bouncing along the at 2% PCE growth per year threshold.

Note: These charts are updated each month, the article discusses late 2012 and 2013.

Click to see larger image

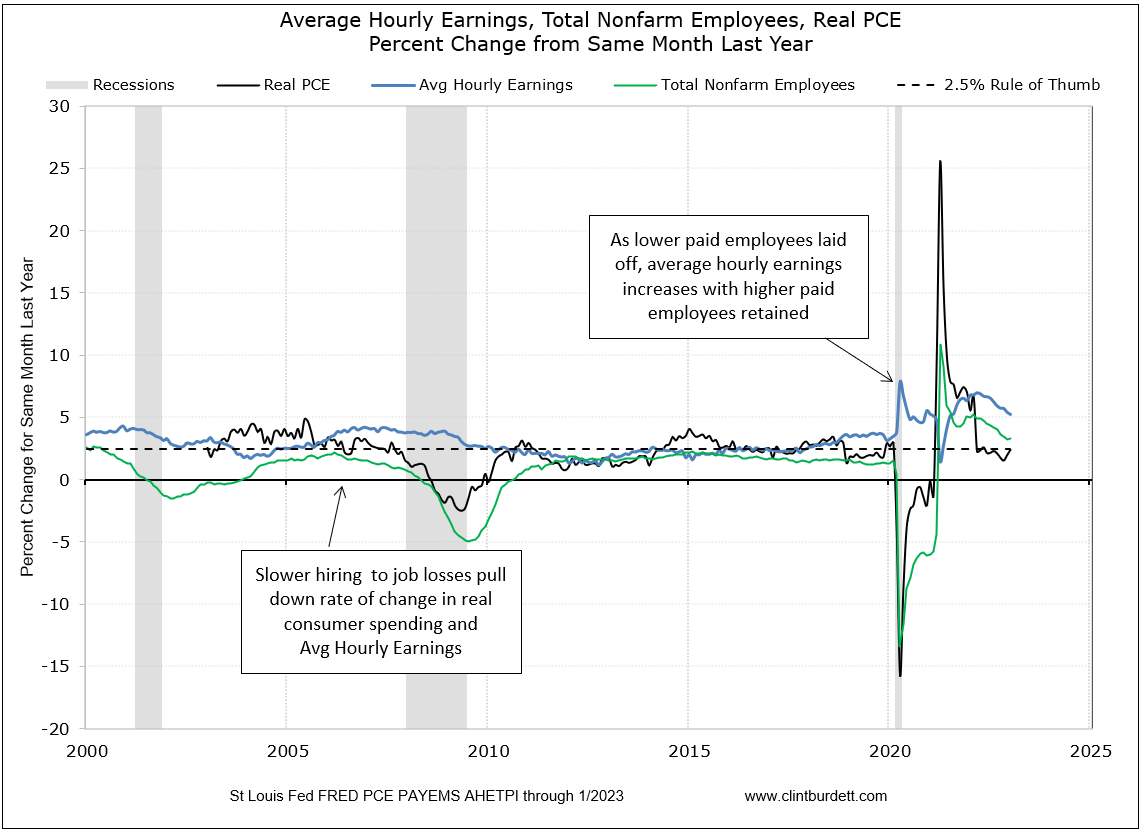

As long as job growth and earnings growth are flat, economic growth will be anemic. (Chart below has the same range, but now 0% centered on the horizontal axis.)

Click to see larger image

You may not reprint this article for sale without my expressed written permission.

You may post or reprint this article to educate as long as you credit my work

and provide a link to www.clintburdett.com

|

|