|

Making

Comparisons:

How

Far to Drill Down

Quantitative data

Relative data

Presenting

Data

Models:

Macro Trends

Porter's Competive Forces

Complementors

Value Chain

Value Proposition:

Customer-Product Match

The Buying Decision

Importance-Performance

Matrix

I/P Matrix Variations

Your Employees

Financials:

Corporate

Business Unit

Department

Who Does The Research |

Macro Trends

I learned early on that strategists extrapolate their knowledge

to predict future events, even though folks always disclaim "no

one can predict the future." So planning teams conduct environmental

analyses, external analyses, trend analyses, etc.

Here I call it macro (outside your firm and it's

immediate market) trend (likely behaviors) analysis.

As a Strategic Planning Consultant with over 25 years of experience,

I have developed a sense of what are reasonable assumptions to

make about future events, since 2008, I have commented

on economic trends in my blog to help me hone my analyses and since 2014 summarize trends in the US business cycle.

The process chapters on this

website help you organize your thinking to formulate strategy.

A macro trend has a long life, a result of many forces in your

community that you cannot manipulate. Like a river, you go with

the current or exhaust yourself fighting it.

Usually, as a strategic

planning team formulates a strategy, we start with and lump trends

into areas of analysis in our external environment - our market

and our community. We are assessing opportunities and threats

for a

SWOT.

|

|

Typical Groups for Macro Trends

- Demographics - population groups, life spans, family composition,

disposable incomes

- Economics - capital, business processes, productivity, work

patterns, management

- Environment - raw resources, ecosystems, transportation channels,

habitat

- Government - world events, politics, laws, public and economic

policy, regulation

- Society - lifestyles, values, religion, leisure, culture, education,

public-health

- Technology - innovations, scientific discoveries, economies

of scale, production and project management tools

A trend may fall under several of areas, but as a strategic planning

facilitator, I resist the temptation to put it under two or more,

since you can overstate importance.

Most strategists feel that four areas need to be studied in detail:

politics, economics, society (demographics) and technology, which

is often called a PEST

assessment, particularly in Europe. Add environmental and legal

trends to get a PESTEL (or PESTLE) assessment. Others call the same assessment method the Five Forces.

A "driver" is a trend in the community, as it builds

momentum, that will trigger an opportunity for your business. For

example, in the 1970s Royal Dutch Shell saw the need for more refineries

as an opportunity with the driver being the 1973 Oil Shock. A current

driver for web meetings is increasing travel costs, which will

increase demand for Webex or Citrix GotoMeeting.

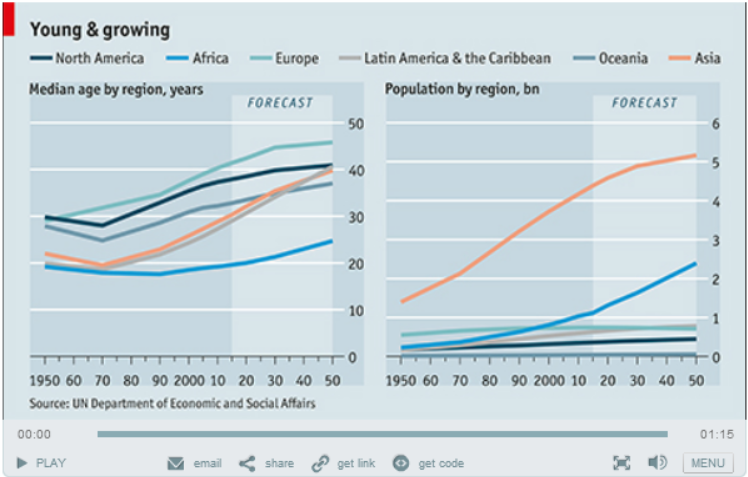

Demographics - we can accurately estimate demographic

trends well into the future.

Here is a 50 year perspective on population median age by region by The Economist Daily Chart team which explains the interest in Affica and it is so well presented. See this superb presentation here.

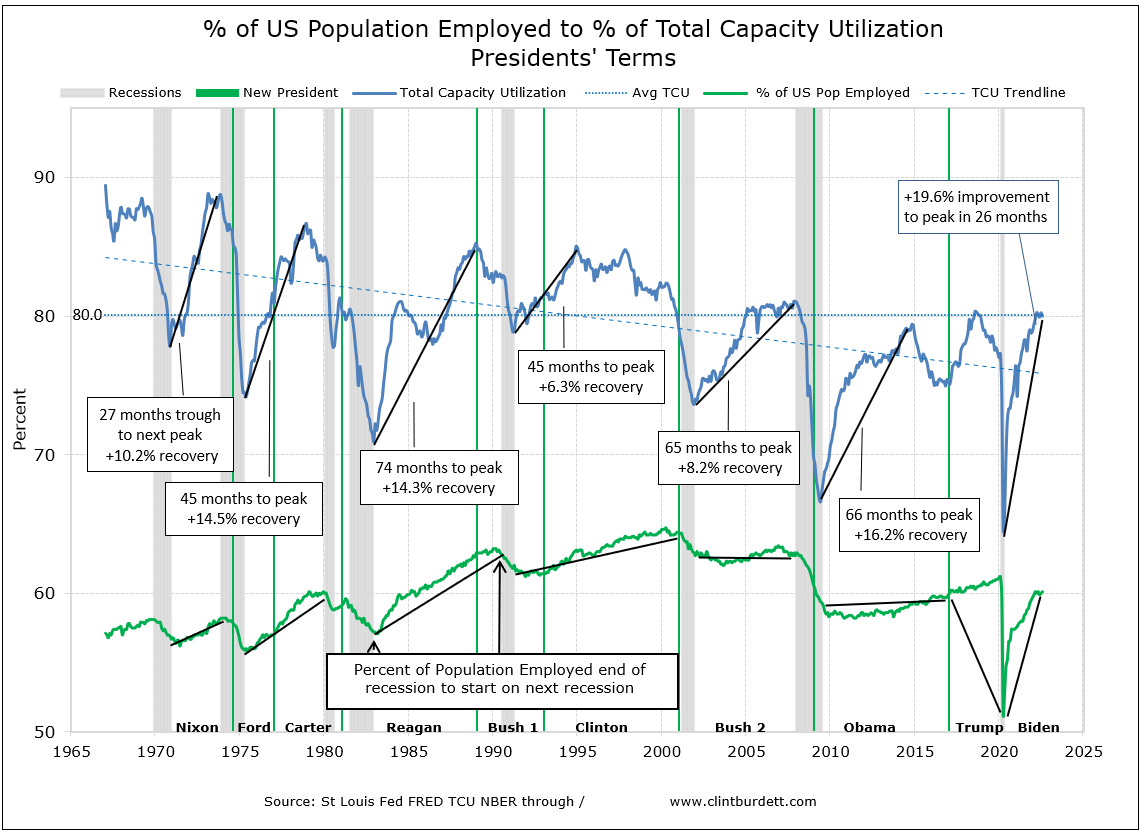

Economics - the business cycle our focus - is

data rich but prone to short term misinterpretation.

This chart shows that peak capacity of US Industries has been

in decline, a long term view. Since the late 1980s, just in time

delivery has "driven" consolidation in the supply chain,

a driver in plant construction and hiring decisions. Demographics

also explain the decline with the Baby Boom generation entering

retirement, there

will be a lower participation rate (Participation Rate = Labor

force / Civilian noninstitutional population).

Politics evolve along the election cycle as "new" majorities

change the rules. Add Presidential elections to the chart above

shows that the business cycle is independent of the election cycle

over the long term. The gray shaded vertical bars are the US recessions,

the start of a recession marks the end of the upturn in the business

cycle. Peak US Capacity Utilization marks the high point of a business

cycle.

Click to see larger image

Click to see larger imageUSA peak capacity

is trending down. Job creation, the percent of the US population

employed (the red line at the bottom of the chart) has peaked and

is also trending down. The slope of the black lines represents

the pace of job creation/month from the end of a recession to the

beginning of the next. The green vertical lines mark inaugurations

of new Presidents (Nixon, Ford, Carter, Reagan, Bush1, Clinton,

Bush2, Obama). The business cycle is independent of the election

cycle: for example, Ford's quiet craftsmanship led to Carter's

burst of job growth; Volker as Chairman of the Federal Reserve

Board killed inflation and Reagan took off; Bush1 built the foundation

for a recovery (and so doing, cost him the election) and then Clinton

bragged; Bush2's tax cuts did not accelerate job creation over

eight years. Presidents react. Individual business choices, structural

changes in competitiveness - the business cycle - create or shed

jobs.

Technology trends are identified from industry

associations as the best firms innovate and create the standards

so their products will have an advantage in the market.

The question is do you move early

or wait? If you wait, do you hedge your bets? Is the trend

an opportunity to take advantage of, or a threat that will make

doing business very difficult? The question is do you move early

or wait? If you wait, do you hedge your bets? Is the trend

an opportunity to take advantage of, or a threat that will make

doing business very difficult?

Next, how do you assess and track these trends.

|